Orders delivered to countries within the European Union

We collect VAT on the net amount of discounts on the items ordered excluding shipping costs.We take care of its repayment to the competent authorities in your country.

We take care of its repayment to the competent authorities in your country.

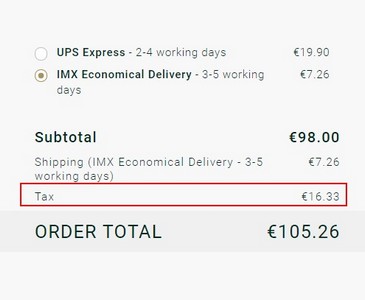

You can view the VAT amount (Tax) when creating your cart:

Orders delivered outside European Union, including DOM/TOM

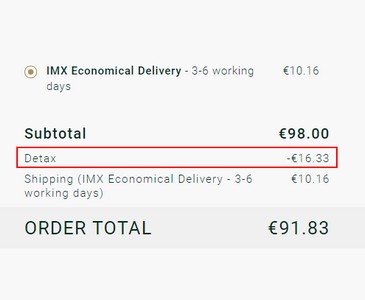

For any order outside the European Union, including DOM/TOM, we do not collect VAT and directly apply the tax refund at the rate of 20% applicable in France.

You will be billed for your order net of discount and tax as in the example below:

Customs may therefore ask to pay the VAT in force in your country upon delivery of your package.

This will be calculated in accordance with the invoice attached to your package on the basis of the total amount excluding VAT of the items in your order, excluding shipping costs.

Orders delivered to the UK – Application of the Brexit Agreement

From 01/01/2021:

- • For any order where the total amount excluding VAT of items <135: we collect the VAT at the British rate of 20% and we take care of its repayment

- • For any order where the total amount excluding VAT of items >135: we do not collect the VAT which it will be up to you to pay at the time of your delivery

The chosen option is calculated directly when your cart is created (the conversion from € to £ is carried out in real time according to the exchange rate updated daily).

Order which item amount < 135£ - VAT paid to Bexley

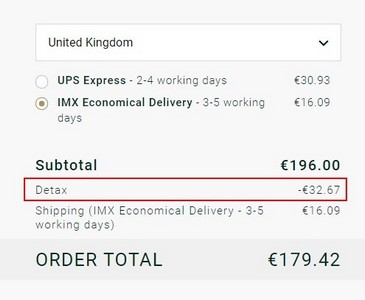

Order which item amount > 135£ - VAT not paid, Detax refund applies

In addition, the invoice attached to your package will strictly reflect the elements of your order so that customs can determine whether or not you should be paid UK VAT when you deliver your package.

30 days

30 days 3D SECURE

3D SECURE